Paramount has made the case for its proposed acquisition of Warner Bros. Discovery in a letter to the company’s shareholders, arguing it delivers “superior value and a faster, more certain path to completion than the Netflix transaction.”

Skydance-owned Paramount, working with RedBird Capital, believes it is the best home for WBD—”not only to build long-term value for the asset but also delight audiences and help cultivate a more vibrant creative community,” said David Ellison, chairman and CEO of Paramount Skydance Corporation. “We funded, founded and then merged Skydance with Paramount and know the sacrifices and investment it takes to capitalize and grow a media business. I am passionate and dedicated to this pursuit, committed to putting my own money in.”

Paramount has gone straight to shareholders with its all-cash $30 per share offer after the WBD board rejected six proposals over the last 12 weeks. Ellison highlighted that its offer is “financially superior to Netflix’s transaction,” which consists of $23.25 per share in cash, $4.50 in stock and a share in WBD’s Global Networks spin-off. “In reality, however, the total value is materially lower than advertised,” Ellison argued.

The Netflix deal “leaves WBD shareholders with 100% of the risk of the Global Networks standalone plan,” the letter continued. “In addition, the Netflix transaction would further exacerbate the decline of Global Networks.”

Ellison also highlighted that it has the financing in place, with $41 billion of new equity backstopped by the Ellison family and RedBird Capital and $54 billion of debt commitments from Bank of America, Citi and Apollo.

“To suggest that we are not ‘good for the money’ (or might commit fraud to try to escape our obligations), as certain reports have speculated, is absurd,” Ellison said. “That absurdity is underscored by the fact that WBD and its advisors never picked up the phone or typed out a responsive text or email to raise any question or concern or to seek any clarification about either the trust or our equity commitment papers.”

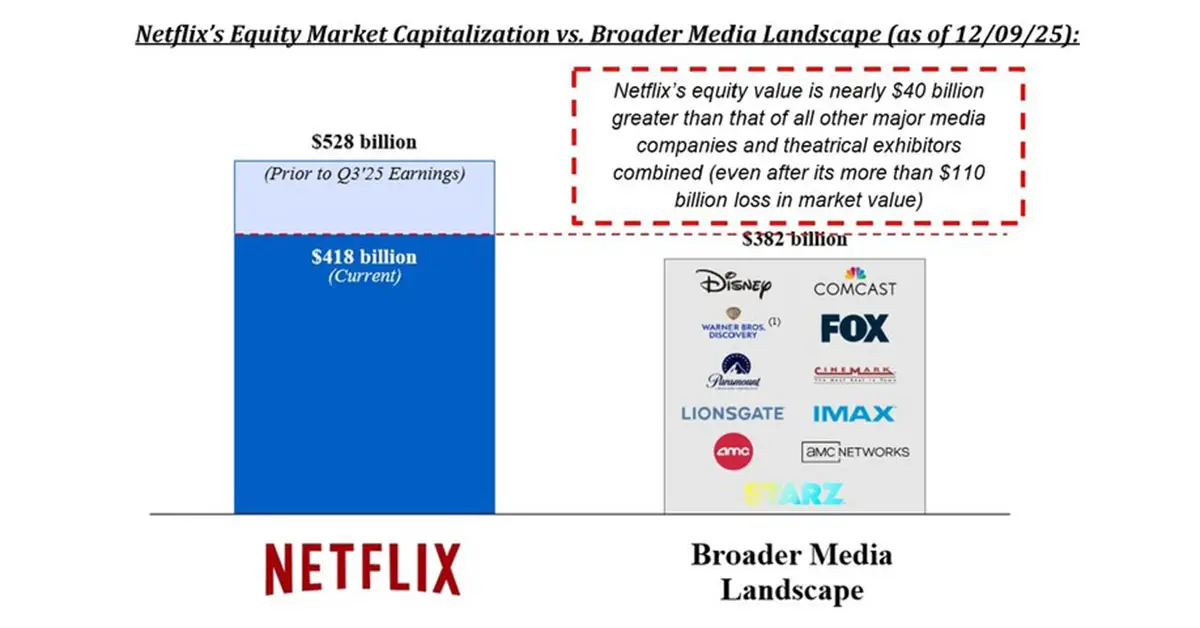

The letter also points to a challenging regulatory process for the deal with Netflix. “Netflix is the number one streaming business globally by subscriber count and HBO Max is number four. Combining these two yields an overwhelming market share of 43%—more than twice the number two. This is in addition to the other serious competition concerns raised, including from vertically integrating WBD’s film and TV production studios into Netflix, which will give Netflix greater leverage over theatrical exhibitors and creative talent alike. Notably, and as an indicator of its global dominance, Netflix’s current equity market capitalization dwarfs that of all other major media companies and theatrical exhibitors combined (even after the above-mentioned $110+ billion loss in value).”

Europe, in particular, will present a regulatory challenge, Ellison said. “Netflix is by far the dominant streaming service in Europe, accounting for 51% of the total European OTT subscription revenue in 2024, with Disney a distant second at only 10%. The acquisition of WBD’s Streaming & Studios business is a blatant attempt to eliminate one of Netflix’s only viable international competitors in HBO Max. Market share analysis aside, Netflix also needs to satisfy Europe’s new landmark Digital Services Act and Digital Markets Act created for a situation precisely like this—protecting consumers from Big Tech overreach.”

Ellison continued, “The argument being advanced publicly by Netflix and its proxies states that regulators should ignore the SVOD market and instead utilize a gerrymandered market definition that includes services like YouTube, TikTok, Instagram, and Facebook. Netflix’s claim boils down to trying to mask its dominance in SVOD by grouping together all internet-enabled video, media, social media, or otherwise. No regulator has ever accepted such a broad approach to market definition, and to do so would require regulators to give up on merger enforcement in media and social media alike.”

Ellison reiterated the company’s commitment to WBD’s theatrical model, stating, “I have profound respect for creative talent. This is why we are fully pro-Hollywood, dedicated to supporting a growing theatrical slate of over 30 films per year and investing in the people and storytelling that drive the industry forward.”

Ellison also criticized a “murky” sales= process. “On that final pivotal day when WBD’s fate hung in the balance, we received not a single call, text or email to clarify anything about Paramount’s $30 per share all cash offer. Instead, and while in possession of our superior and fully committed bid and documents that entire day, the WBD Board and its advisors sprinted toward a deal with Netflix (even ignoring two separate texts from myself and Paramount’s advisors stating that we had never said ‘best and final’).”

Ellison asserted that “a number of WBD shareholders have expressed confusion and disappointment at the process that WBD conducted, which appears to have prioritized a deal with Netflix over shareholder value maximization. Multiple equity research notes published over the last 48 hours have also agreed that our offer is superior and that the Global Networks spin-off does not close the gap to $30.00 in cash.”